At its November 13th meeting, the Amherst Town Council heard a presentation from Assessor Kimberly Mew detailing the new assessments and a proposal for new tax rate.

The annual tax bill for the average single-family homeowner in Amherst is now over $9,000. And the estimated value of the average single-family house has topped $500,000 for the first time. The average value, calculated by the assessor’s office, was $446,953 last year and $404,700 the year before that.

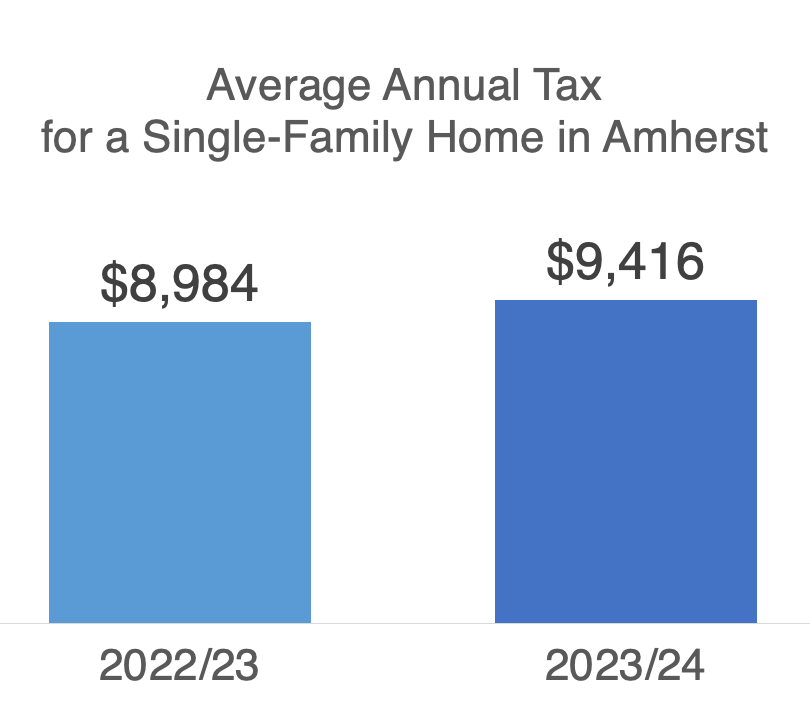

This will drive the annual tax bill to $9,416 for a single-family home, up 4.8 percent from last year’s average of $8,984.

Assessed values of all properties are rising by 15 percent. The average valuation for a single-family home in Amherst is now $508,713. Under state law, this calculation is based on actual sale prices in 2022. The average commercial property valuation is approximately $596,000, resulting in an annual tax of $11,033.

The tax rate is calculated by dividing the total amount to be raised through the property tax by the total valuation. The tax rate typically goes down when property values go up. The new rate is estimated at $18.51 per $1,000 of assessed valuation. That’s lower by $1.59, or just under 8 percent, than the previous fiscal year’s rate, and $2.76, or about 13 percent, below the rate from two years ago.

On Monday night the Town Council voted unanimously to approve a single tax rate for all classes of property, including residential, industrial, commercial, and personal, as recommended by Mew. Residential property in Amherst is responsible for 89 percent of the tax revenue raised. Personal property is all movable property such as business and professional furnishings or household furnishings in property other than the principal residence.

Having separate rates would place a heavy burden on commercial property owners because of their small numbers, Mew said.

The Town Council also voted unanimously against exemptions for some residential and commercial properties, per the assessor’s recommendation. The proposals would have given breaks to lower-valued residential properties and businesses with fewer than 10 employees and valued at under $1 million, but would shift a greater burden to higher-valued properties.

That could negatively affect renters in multi-unit properties, who would absorb the higher costs, Mew said. The vast majority of businesses in town would qualify for an exemption, shifting the burden to a small number of larger businesses.

The tax bills that were due August 1 and November 1 were estimates. Tax bills for the third and fourth quarters of the current fiscal year will be sent out in late December. They will be due on February 1 and May 1 and will be adjusted to reflect the annual tax obligation for the entire fiscal year.

To find out the valuation of your property, go to https://www.amherstma.gov, click on Assessors then click Online Data Base and enter your street address. Go to https://www.amherstma.gov/106/Exemptions for information on property tax exemptions.

If you disagree with your property assessment, contact the assessor’s office. You may file an appeal of your assessment, called an abatement application, found at https://amherstma.gov/DocumentCenter/View/59890/Real–and-Personal-Property-Abatement–.

David Porter grew up in Amherst and spent many years as a sports and courts writer for the Associated Press. He returned to Amherst with his wife, son, and cat.

Discover more from THE AMHERST CURRENT

Subscribe to get the latest posts sent to your email.

The closed loop of Amherst property taxes:

1. The lack of commercial enterprises in town (thanks to Amherst’s historically hostile stance toward such enterprises) creates the disproportionate tax burden borne by residential property owners.

2. Thanks to the small number of commercial enterprises, reducing the disparity by giving them a higher tax rate is deemed to impose a “heavy burden”, i.e., a disproportionate tax increase.

3. Commercial enterprises are spared a higher tax rate, perpetuating the disproportionate tax burden on residential property owners.

This is why I voted against the most recent 2.5% tax override.

LikeLike

Isn’t it time to distinguish between owner/occupied AND rental housing and other non-residential improvements, except for agricultural land and improvements?

LikeLike

Paul, it’s my understanding that for tax purposes, the Town could not do anything about your suggestion. You would have to take on State law to make such changes. And if the legislature ever took this up, it’s my guess there would be one hell of a donnybrook!

LikeLike

I must have done something wrong because my last post hasn’t appeared. What I wrote about is that there is a flaw in this post. The same flaw appears in Mr. Merzbach’s recent article on this topic. Your tax bills is not based solely on the value of your home. It’s much more complicated than that. Compared only to your neighbor’s tax bill, it is absolutely based on the value of your property compared to your neighbor’s. However, the value of our homes could go up and we could have a lower tax bill. The tax bill is based on the tax levy which is made up of last year’s tax levy, plus new construction, plus up to a 2.5% additional tax levy increase. That new tax levy number is then used to figure out what the tax rate will be. As far as I can remember, Amherst has always taken the max levy increase allowed by law; I suspect this year is no different. To blame it on new valuations is misleading and likely confusing to residents. Taxes go up because of the budget, pure and simple. Always have, always will no matter if we have a TM gov’t or a Town Counsel gov’t. The only way residential property taxes will go down is if Amherst gets a very robust commercial sector, which it has shown no sign of doing, under a Town Counsel gov’t nor under the previous TM gov’t. It’s important to note that all the new apartment buildings in town are not beefing up our commercial base; they are taxed as residential buildings, thus they are actually making the ratio of residential to commercial properties even greater.

LikeLike

I read this post by Mr. Porter with a similar reaction as Mr. Weiss’s. How one can do a blog post about taxation without EVER referencing the caps imposed by state law under Proposition 2.5 is beyond me. I know it’s counter-intuitive but, as Mr. Weiss points out, the assessed valuations are just not that important. So, in an unusual moment of agreement for me with Mr. Weiss, the emphasis of this blog post seems considerably off to me. Essentially, we always spend up to or near the seemingly draconian limits on our taxing authority imposed by the state caps, and then we have to scramble around either for additional revenues OR to make the painful cuts. Given the choices we’ve made over decades, whether under the radar or not, about land use and commercial development, and the large areas of college and university land exempt from tax, revenue to fund town services and capital needs will be a problem for the foreseeable future in Amherst. This initial foray into this topic by Amherst Current is disappointing to me.

LikeLike

A single rate tax was not “introduced.” It was maintained. As it has been every single year for as long as I can remember. Thereby I’d guess it’s not just that the “average single-family homeowner’s tax bill in Amherst will rise by 4.8% due to a 15% increase in all property values” but COM and IND will also rise. It’s hard and high but considering and keeping one tax rate happens annually from what I’ve witnessed.

LikeLike

Cinda is correct that the single tax rate was maintained, not introduced. The thinking has always been that because we have such a small COM and IND base, a split tax rate would critically harm the little commerce and industry we have, as well as likely raising rental rates in apartment buildings, thereby hurting lower income rentals. Every Select Board in Amherst and now Town Council has agreed with this theory and not voted a split tax rate. Cinda is also correct about all tax categories paying the increase. But again, it is not due to the 15% increase in property values. One other interesting fact is that commercial buildings are assessed with different tools than homes by using a complex formula, which includes income. For instance, 1 East Pleasant Street is a Commercial building when it’s being assessed but is a residential building when being taxed (except for the first floor). I have no idea if that is an equitable way to do taxes, but it’s the State law. Someone could, do a study of tax increases over time for homes vs tax increases over time for one of the apartment buildings in town and see if they are in line with each other.

LikeLike