By Nick Grabbe

In 1984, I bought my house near the middle school for $66,000. It is now worth about $470,000, a sevenfold increase. This increase in house prices has been great for the net worth of homeowners like me. But I believe it has had negative consequences for Amherst as a community.

The median sale price of a single-family house this year has been an eye-popping $603,000, compared to $300,000 in 2012, according to the Barrett Group, the consultants hired to address our housing challenges. The median condominium price is now $318,750, way up from $153,375 in 2011.

Rents have gone way up, too. I reviewed the first 35 ads for Amherst rentals on the UMass off-campus housing site and found that they averaged $1,220 per bedroom. A studio apartment at One East Pleasant goes for $1,930 a month.

Here are some problems that this inflation in housing costs has created:

The rich get richer. Homeowners, who are more likely to be white and well off, are accumulating wealth, while renters, who are more likely to be students and/or people of color, are paying higher rents without building equity. The average annual income for homeowners in Amherst is $137,102, while for renters it’s $37,617, a much wider disparity than in Massachusetts as a whole, according to the consultants.

Young families are shut out. It has become very difficult for young couples to afford a single-family house in Amherst. While the over-65 Amherst population has grown from 6.6 percent in 2000 to 10.2 percent in 2020, the number of students in the public schools has dropped by 40 percent (from 3,648 to 2,193), according to the consultants. Charter schools and demographic trends have also contributed to the enrollment decline.

Students and service employees struggle to find housing. Twenty-eight percent of the households in Amherst are “severely cost-burdened,” meaning they spend more than 50 percent of their incomes on rent, according to the consultants. Some UMass students, unable to find housing in Amherst they can afford, have looked for apartments in Easthampton or Springfield. Wait staff and retail workers often have long commutes and/or crowded living spaces.

More social stratification. It becomes more difficult for Amherst to see itself as a unified community when the gap between homeowners and renters is wide and widening. While the Survival Center has met a much greater need for free food, Amherst households with annual incomes over $150,000 are now 24.1 percent of the population, up from 13.8 percent in 2012, according to the consultants.

Greater budget pressure. It has become more challenging for people who work at Town Hall or the public schools to afford a place to live in Amherst. So it’s not surprising when their unions advocate for pay increases. When they are granted, it becomes more difficult to keep the town’s budget within its limits and to avoid asking residents to raise their already-high taxes.

These problems are not new. “There is an overwhelming consensus among those living, working and wanting to live in Amherst that there is a critical need for increasing access to affordable housing, both for rentals and home ownership,” according to a summary of a listening session held last year.

Housing expert Connie Kruger addressed the price gap, the “missing middle,” and a housing proposal before the Town Council in this Amherst Current post. She reported here about the new state law prohibiting towns, including Amherst, from requiring owner occupancy for accessory dwelling units (ADUs). State action may be necessary to overcome local governments’ resistance to zoning changes designed to make housing more attainable.

The Barrett Group has been conducting interviews about housing, and they plan to do an online survey this month. The consultants will organize focus groups on implementation strategies in January, and are due to provide a final housing production plan in April, when the public can review it.

What the market dictates for developers and what’s actually needed are not the same, said consultant Judi Barrett. “There are too many needs competing for the same inadequate supply,” she said at a public presentation on October 1.

These higher prices are probably the new normal. Like property taxes, house prices seldom go down. Even in the subprime mortgage crisis of 2008, when average U.S. house prices declined by over 20 percent, in Amherst they held steady.

Barrett outlined some changes since the housing plan was updated in 2013: Amherst has more higher-end apartments, more investors are buying houses and converting them to student rentals, more students are living off campus, and young families and the workforce face increased housing challenges. UMass, and Amherst and Hampshire colleges have 4,213 more students than it did in 2010.

Meanwhile, construction costs have soared in the past five years, making it extremely difficult to build affordable housing without governmental subsidies.

Because Amherst has little available land that’s suitable for development, the most commonly voiced response to housing scarcity is increased density. But neighbors often resist, and have gotten good at resisting, said former Select Board Chair Elisa Campbell at the October 1 meeting. Former Town Meeting Moderator Francesca Maltese articulated a key question: “How dense can we allow Amherst to be and still be a nice town?”

Amherst has been making some progress lately, with plans for lower-cost housing at the former East Street School, the former VFW building on Main Street, and on Ball Lane in North Amherst.

The Affordable Housing Trust drafted an ambitious action plan in September. It included the creation of 200 homes, for rent or ownership, over the next five years. The draft plan proposed finding $4 million to support this effort, perhaps through a 3% “community impact fee” on short-term rentals, a real estate transfer fee, and a contribution from the Community Preservation Act fund.

Amherst is not likely to abolish single-family zoning to increase density and affordability, as Minneapolis did. But many other strategies were voiced at last year’s listening session, all with pluses and minuses. They included subsidized rents, getting UMass to build more on-campus housing, rent control, tiny houses, disincentives for turning homes into student rentals, a tax on college meals, and banning Airbnbs. Here’s a link to more details.

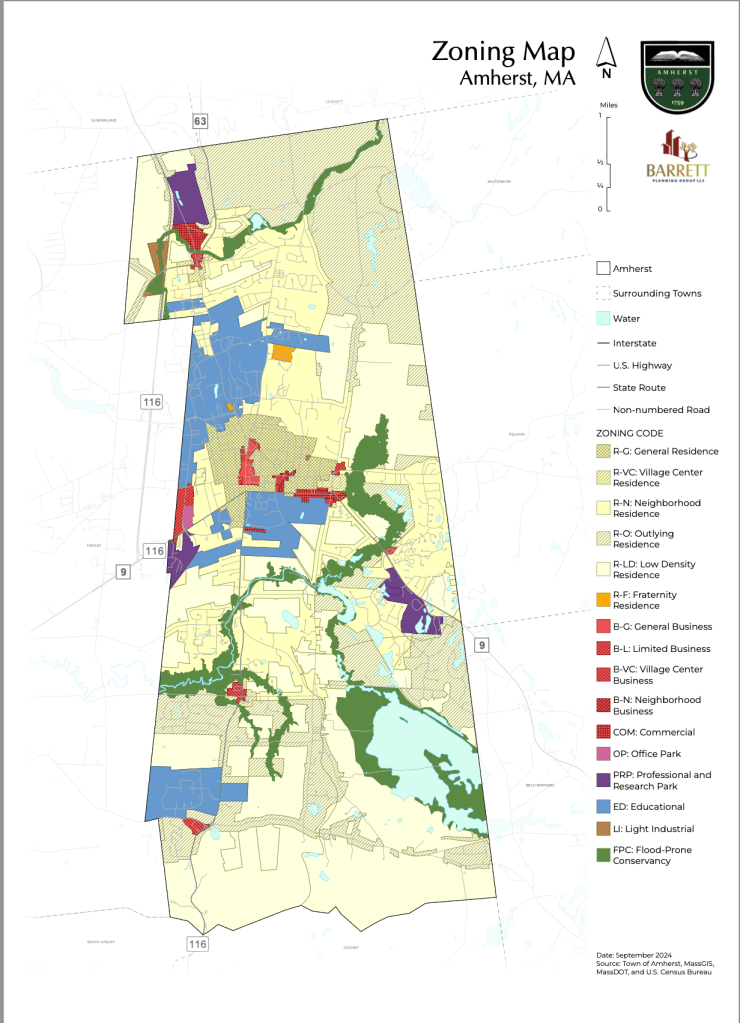

Amherst’s zoning map shows districts that are known by acronyms, such as RG (General Residence) and BL (Limited Business), each with their own development rules. A frustrated wag once said that Amherst should create a new zoning district where all kinds of development would be allowed. It would be called SEN, which stands for Someone Else’s Neighborhood.

It’s easy to say that Amherst needs to build more housing. But it can be hard to convince residents to support changes that would allow that to happen.

Nick Grabbe is a co-founder of The Amherst Current. He has been a resident of Amherst for nearly 40 years and served as writer and editor for the Amherst Bulletin and the Daily Hampshire Gazette 1980-2013.

Discover more from THE AMHERST CURRENT

Subscribe to get the latest posts sent to your email.

Great article Nick, and a topic near and dear to the heart of Amherst residents that would like to see young adults be able to start their families in town. The Minneapolis approach of “rolling back single-family zoning” to spur the development of “duplexes, triplexes, and other ‘missing middle’ housing” is an intriguing one. But that would require the acceptance of multifamily housing where there virtually has been none built in the last couple of decades. Such zoning could change the complexion of a neighborhood in a hurry, spurring pushback of the intended redevelopment. Meanwhile, out of a separate need for student rentals, former single-family homes have been converted to student housing . . . properties that surely could have been starter homes, perhaps if there were some creative incentives concocted for the seller and/or buyer. The Amherst housing problem is unique, but we can see that our region is not alone in grappling with this issue.

LikeLike

That increase in home prices amounts to about 6% per year, or maybe 2% per year after inflation. I wouldn’t call that”skyrocketing”. In fact, it’s much less of an increase than in other parts of the state, especially the Boston suburbs, and not a great return on housing investment, especially when the rise in property taxes, insurance, and maintenance costs are taken into account. Perhaps the emphasis should be on holding down the rise in property taxes and other housing costs.

LikeLike

Thanks so much for such an informative article Nick! Most of these figures I haven’t seen before, and put numbers to what many have been feeling. I think it’s excellent that you have explored this issue in much more detail than has been done in the past.

It’s interesting to see that more wealthy people have moved to town, while the number of lower and middle class people living in town has declined by about 11% in total. This exodus from town surely includes teachers, firefighters, dpw staff and others at Town Hall who need a raise. No matter how financially savvy you are, nobody making 68k can comfortably afford a 630k home, so naturally many move to towns where they can afford a single family house on that salary. Affordable housing is a problem nearly everywhere, however Amherst has it worse than many comparable nearby communities. This is because of four factors that are less common in our neighboring towns.

1. Investment firms buying up single family homes for student housing (outbidding families, and raising rents for their profit margins.) This causes a large increase in home prices, and accounts for much of the recent cost increases that have been worse than at any time period in recent history (See Nick’s Graph).

2. Large new housing developments downtown. These buildings have set some of their rents at nearly $2,000. This not only is very expensive for what the students living there get, but given how many units Archipelago Investments has built, it allows other landlords to raise their rents for comparable units and makes renting more expensive in Amherst overall. Some towns don’t allow this type of exploitation by large developers. The Planning Board should ask what rents will be before approving a development.

3. Given that more wealthy people are moving to Amherst (the percentage of those making more than 150k who live in town has doubled). They are also looking for places to live, and can outbid families of less means looking for a home, and are less likely to be renting when moving to town, putting more pressure on the market.

4. 8 students living together in an off campus apartment, at $1,000 per bedroom bring in $8,000 per month for one property. This allows developers to bid even higher on houses, given the high return on their investment. In addition, it makes them eager to rent to students in large numbers, who will pay much more in total than most families ever will.

All four of these issues are more unique to Amherst, and can not be explained by “a national issue.” Instead they are four issues that the Town Manager and Town Council, in collaboration with the Planning Board should consider addressing, through a combination of bylaws, zoning changes, and permit approval or denial. We can’t just argue over building more densely, or preserving historic structures, it is more nuanced than that. We need to build more units for families of modest means. Building more Archipelago Investment buildings, and Amherst Woods type developments only makes things worse when it comes to affordable housing. More condominiums, tiny homes, income restricted neighborhoods, and rent control might help. Another idea is passing bylaws forbidding investment firms from buying up single family homes. Amherst’s Town Council should take a shot at drafting a local version of a law like this:

LikeLike

I regret to inform you a few items, these challenges are not unique to Amherst, referring to rising costs and demographic shifts. I don’t know how well this table will show up, but there were actually more students living off campus in 1982 (13,939 off campus students) than there are in 2022 (12,730) thanks to online learning. The demographic shift with less people living between 25-45 certainly leads to smaller household sizes, imagine 1 or 2 instead of 4-6. The income gap should not be a surprise because the largest demographic of renters are students who do not work full time. Please see the following table to have a deeper understanding of the University enrollment and off campus housing.

Year Assoc Bachelor’s Grad FT Grad PT Online Total UG Beds Net off campus

1982 367 19,226 5,356 n/a 0 24,939 11,000 13,939

1992 327 16,885 5,816 n/a 0 23,028 11,000 12,028

2002 273 17,603 2,211 3,245 700 24,062 11,108 12,254

2012 177 21,751 2,105 2,162 5,602 28,236 12,237 10,397

2022 45 23,101 2,377 2,183 4,523 32,229 14,005 13,701

2023 41 22,813 2,478 2,028 4,390 31,750 14,630 12,730

Net off campus is total enrolled less online less UG beds

Other variables not incorporated in this discussion surrounding rising costs is fewer people in the trades in general and the same amount of demand for those services. Leads to an increase in cost of labor for maintaining a home. Think about the electrician, plumber, hvac technician, landscapers, handy people etc.

Also didn’t account for rising costs of supplies and materials from recent supply chain constraints.

Good article, but Amherst housing problem is not unique to Amherst. Thank you for writing this to keep the discussion around housing growing Mr. Grabbe.

Tom Crossman

LikeLike

Thanks for this well-researched and thoughtful reporting, Nick. You’ve broken a big, complex problem into understandable pieces. How fortunate Amherst is to still benefit from your superb journalism some years after your retirement from the Gazette.

LikeLike