By Alex Cox || coxalexj@gmail.com

A report on the special joint meeting of the Budget Coordinating Group (Town Council, Finance Committee, School Committee, Regional School Committees, and Library Trustees)

Members of the Town of Amherst finance team shared their projections for the Fiscal Year 2026 (FY2026) at the Monday joint meeting of the Town Council, Finance Committee, School Committee, Regional School Committee, and Jones Library Trustees.

The presentation, led by Finance Director Melissa Zawadzki, Town Manager Paul Bockelman, Treasurer/Collector Jennifer LaFountain, and Comptroller Holly Drake, included the preliminary assumptions and projections that will guide the budgeting process for FY2026.

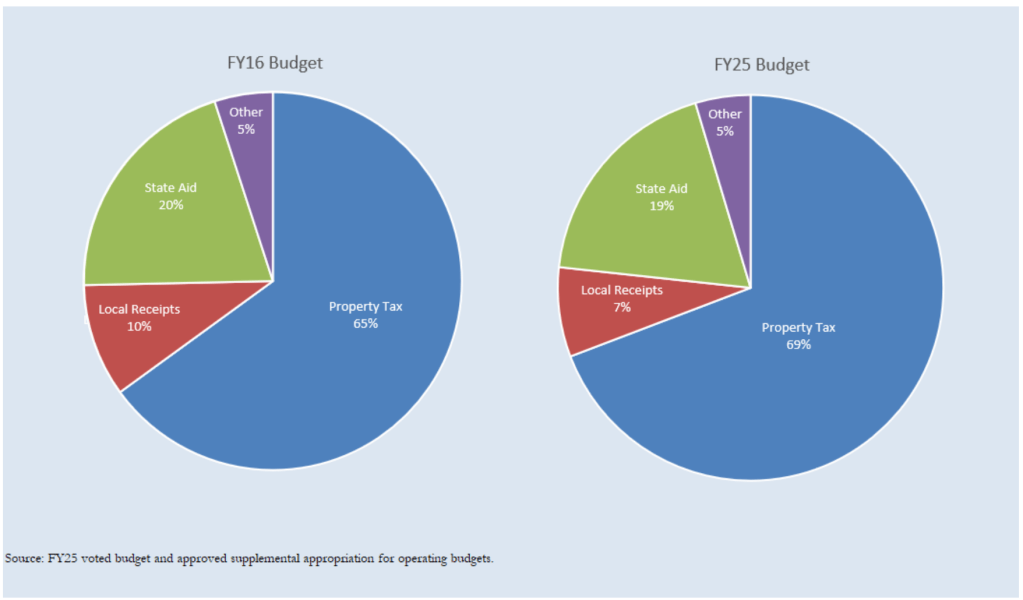

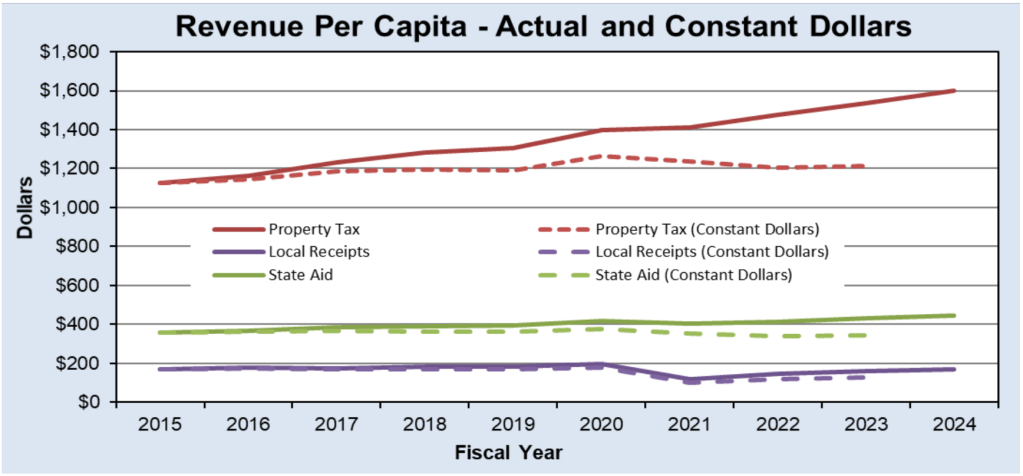

Overall, the projections indicate a slightly higher revenue (current dollars) for the Town in FY2026. This is in line with the average revenue increase of 3.4% year-over-year for the past decade. However, the makeup of this revenue is changing. “The distribution of this revenue is shifting from state and local receipts to the property tax base… we are becoming more and more dependent on the property tax our town collects,” said Zawadzki. Although this property tax revenue is expected to increase by 2.5% (in line with Massachusetts Proposition 2½), this larger levy may not outpace inflation – a trend that is visible in the FY2020 and 2021 budget cycles.

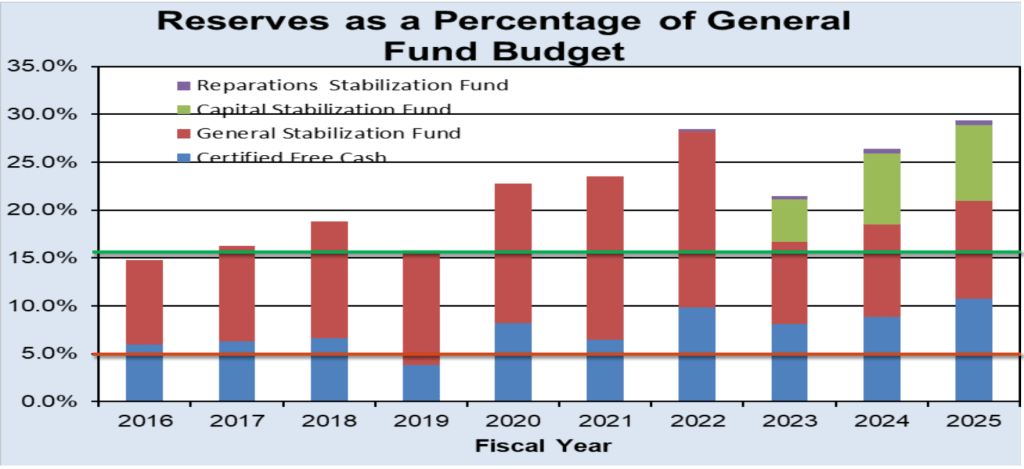

Bockelman and Zawadzki cited inflation as one of the principal challenges (along with rising cost of health insurance, with an expected increase of 10-15% in this coming fiscal year, and increasing contributions to retirement funds and OPEB benefits). Despite these and other challenges, town staff cited signs of a strong financial portfolio, including the recent reaffirmation of the Town’s AA+ Bond Rating by S&P Global Ratings. This rating shows investors that Amherst maintains a “very strong capacity to meet financial commitments” and will be increasingly important as the town issues debt to finance capital projects, including the Elementary School, Department of Public Works, and Library Expansion projects. The Town has slowly been building up the reserves held in the Capital Stabilization Fund to offset the impact of these major capital projects on the taxpayer and to fund the construction of a new Fire Station, which the Town is hoping to pay for without an override. Currently, the Town reserves sit at approximately $28.6 million – an amount that has been steadily increasing after a $5 million transfer in FY2023 to “reduce the impact of the debt exclusion on taxpayers”.

Based on these and other indicators, the Town is projecting a 3% increase each for the Town, Library, Regional Schools, and Elementary Schools budget in FY2026. (The increase for the Regional Schools’ budget would not be calculated on the 6% increase given earlier in 2024, but on the original budget before the ARPA funds were applied).

Notably, these are very preliminary projections and not a budget or final guidance. Rather, they are information being shared so that all of the departments can operate under the same assumptions throughout the budgeting process. Since many expenses (including labor contracts, health insurance, and interest rates) are not yet set and revenues (including state aid and taxes) are not yet known quantities, the Town is being conservative with the estimates.

“As we get more information, we tighten them up to be more aggressive with our budgeting,” Bockelman said when questioned about the accuracy of the projections. “We can’t be 100% accurate looking forward. The mission of the professional staff is to make sure that [a negative budget] never happens in the Town of Amherst.”

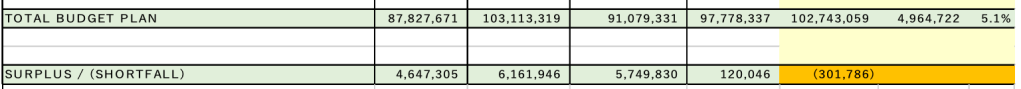

In the FY24 budget, the projections slightly underestimated revenue, leading to a roughly 5.9% surplus in the Town budget (roughly $5.75 million). These monies came from various sources, including investment interest, underspending on staffing due to vacancy, and construction bids coming in under the expected amount. The surplus funds are included in appropriations to projects and reserves that were referred to committee during the regular meeting of the Town Council, according to Drake.

During the question period of the presentation, members of the Amherst School Committee, Regional School Committee, and Town Council questioned the seemingly consistent surplus that the Town is generating. Bockelman, Drake, and Zawadzki repeatedly stated that this surplus is not necessarily a failing of the budget process, but rather a result of unexpected and unpredictable one-time sources. If the Town were to increase its level of risk tolerance, the budget would be more likely to run a deficit on any given year.

Despite this explanation, some members of the School Committees expressed displeasure at the projections and previous budgets. Amherst members Bridget Hynes, Deborah Leonard, and Sarah Marshall all shared frustration with the surplus and allocation process, with Hynes saying that “it feels like different fiscal universes” when the Town does not immediately meet funding requests for the schools but generates a surplus. The conversation escalated, with Shutesbury representative Anna Heard yelling, “I don’t feel heard. None of that conversation [from the Four Towns meeting] is reflected in this budget.”

Bockelman repeated that this is not a budget, but is a preliminary projection. If the Town is comfortable carrying more risk (adopting a less conservative projection model), Bockelman repeated, the Town Council must direct Town staff to change their tolerances. However, Bockelman and Zawadksi cited dangers in this option, saying that uncertain economic futures could more easily turn a less-conservative budget negative. Councilor Mandi Jo Hanneke (At-Large) further clarified that the Town “did not make any agreements at the [Four Towns] meeting,” which Councilor Andrew Steinberg (At-Large) agreed with. Steinberg further supported the Town Manager in advocating for a healthy surplus.

Regardless of the level of risk involved in the Town’s projections, Council President Lynn Griesemer (District 2) reminded participants (again) that “this is the opening discussion. We do not close this discussion until June 30, 2025.” Griesemer further pointed out how transparent the Town was being with its projections, information that is not required by State Law to be published at this point in time. “I don’t know of any other town that is quite as open about their finances.”

Alex Cox (he/him) is a current graduate student at UMass- Amherst studying Regional Planning (MRP) and Public Policy and Administration (MPPA). He currently serves on the Amherst Affordable Housing Trust Fund and as the Graduate Director of the Student Union Art Gallery. He has been a member of the Amherst Current editorial board since 2024.

Discover more from THE AMHERST CURRENT

Subscribe to get the latest posts sent to your email.